Invoicing historically is outside the sight of a banker. Why is it then that it is worth for bankers to start thinking about it?

There is one definite answer for it, the access to INVOICE DATA.

Both words of the expression are equally important, but as banks can have a natural reaction as “What do I have to do with e-invoicing?”, let us start with the DATA part.

Concept and manifestation for invoicing and payments

Invoicing and payments conceptually are very close to each other, as you will see below, but the traditional manifestation (i.e., when doing it on paper, or in different IT systems) of these financial administration activities and the underlying documents caused the mental separation from the concept. Technology today, however, brings the two concepts again closer to each other. If we look at invoicing and payments from a pure data perspective, they become very similar again.

The concept of invoice and payment

Invoice

The invoice is a document (containing structured data) prepared based on a set of tax and accounting rules, which contains a certain set of information to document a transaction between two parties.

Payment

Payment is the exchange of money between two parties. A non-cash payment is documented by a payment document, which is prepared based on a set of rules for information exchange. A non-cash payment is executed by payment service providers (banks).

Manifestation

Invoice

As we have known it for many decades or even centuries, the invoice document is a piece of paper. Today, if an invoice is not printed out, most of us know it as a pdf document. With e-invoicing regulations, the invoice will be a structured data document, having a standardized data structure to ensure interoperability for automatic processing of data.

Payment

The non-cash payment transaction is manifested in a payment message, which is a standardized data structure, so that interbank payments can happen in an interoperable way.

As you can see, the interoperability in invoicing is lagging behind the payment interoperability ensured by banks. While the need for interoperability for banks has been long inevitable to execute payments, the need for invoicing interoperability has just started to take place. Hence, invoicing and payments processes in companies are still fragmented.

But if we look at the purchase to-pay or order to cash (or today together the integrated digital trade) process from a data perspective, you can see that the invoice data is the richest dataset in the whole process flow.

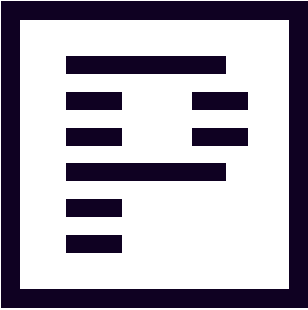

On the below figure you can see the structured datasets that are included in the documents accompanying the purchase-to-pay process steps. For example, orders and contracts contain the buyer and supplier data (entity data), the products/services to be bought/sold and the delivery terms and dates.

On the other end of the process, the payment message contains the entity data (buyer and supplier), the payment means (credit transfer, card payment, cash, etc.) and the payment terms (i.e., when the payment should be executed).

If we look at the invoice data, both the data related to the business transaction and the payment information is included. In addition to this accounting and tax information is put onto the invoice. So, you can see that the invoice data contains the most data about a business transaction.

If the invoice is financed, then the invoice and additional documents (the contract and proof of delivery) is required for financing it. So, the starting point of the financing transaction is also the invoice data.

Figure 1: Data sets in the purchase-to-pay/oder to cash process

Why e-invoicing and e-invoice data is important for banks?

For banks providing beyond banking services related to e-invoicing and digital invoice management will be a competitive factor:

1. The bank can help sort out a significant problem for SME customers, it can provide value added services for corporate customers using invoice data and can store retail customer bills digitally.

2. It will have access to digital invoice data, which ensures that the bank can provide a seamless customer experience for payments and receivables financing.

E-invoicing interoperability will enable enterprises to digitally process their invoices as digital invoice data is accessible. From a bank’s perspective invoice data is interesting, because it has all data that can support digital banking processes, such as payments and financing as explained above.

The invoice document

The invoice document is a means of communication between the seller and the buyer about a business transaction. As such, the invoice document contains a lot of data (up to 2000 data fields), some of them are mandatory by tax and accounting regulation (such as tax point date, supplier and buyer information, tax information), some of them are additional information for processing the business transaction on the seller and/or buyer side (order number, item level special information such as item codes).

An invoice document contains generally the following information:

- Invoice document unique identifier

- Invoice document type

-sales invoice

-credit note

-delivery note - Invoice currency

- Order reference

- Supplier information

-Name

-Address

-Country

-Tax number

-Tax scheme

-Contact person - Customer information

-Name

-Address

-Country

-Tax number

-Tax scheme

-Contact person - Payment means (cash, credit transfer, card payment, etc.)

- Payee bank account information

- Invoice currency

- Dates related to the invoice

-Issue date

-Due date

-Tax point date

-Invoice period - Item information

-Item name

-Unit measure

-Unit price - Discount information

-Item level discount

-Total discount - Tax key per item

- Net invoice amount

- Tax amount

- Gross invoice amount

- Payable invoice amount

- Tax exchange rate

-Source currency

-Target currency

-Exchange rate - Comment sections for additional information related to the above or extra information (e.g., item codes, QR codes or payment links)

The different uses of invoice data

From a business perspective each invoice is a payment or financing opportunity for the bank. Therefore, the bank should have access to invoice data, in the best case in a digital format, which is structured and standardized. Below you can read about the ways a bank can use and utilize the value of invoice data.

Invoice data as input to digital processes

Structured data are prerequisites to set-up digital processes and digital only customer experience.

When you set-up a new digital service, such as a digital only payment experience or lending product what do you need as inputs? The answer is structured data. You can ask your customers to input data manually or get hold of data in an automated way. If there is an automated way, would you risk of your customer leave the process, just because it requires too much manual data inputs? I am sure, your CX team would vote for the latter.

Invoice data provides the convenience of all necessary data for payments and digital lending.

Digital invoice financing, supply chain financing and payment and reconciliation processes all should use digital data inputs whenever available.

If the customer has an outgoing invoice and would like to finance it, it is enough just to click on the invoice that needs to be financed in the online or mobile bank. This 1-click action can initiate all other processes within the bank – and could provide a real-time pricing and loan decision for that specific invoice when integrated with the bank’s scoring system.

In case of supply chain financing or dynamic discounting programmes at corporates, digital invoice data flows through more organisations with approval workflows attached along with a financing request. The availability of digital invoice data is the input that can help the whole business case digitalize. There is a huge unrealized potential in these products, which cannot be utilized mostly because digital invoice data is not accessible.

Data analytics

1. Can we agree that the more data we have is the better? – I think if I asked this question on a presentation, the answer would be congruent “yes”.

2. Can we agree that the more detailed the data is the better? – Again, I think today nobody would answer with a no.

Even if we do not know how to use the data yet, the more and more detailed data is better for analytics, especially for analytics enhanced with AI capabilities.

How can you use invoice data for modelling?

You can incorporate data into cash flow, risk, and segmentation models for the bank and for the banking customers the bank can provide useful dashboards as part of a BFM solution and share some of the insights from the models with banking customers.

Beyond banking services for the SME sector

As banking data becomes available to 3rd parties and non-banking competitors tap into banks’ traditional business with payment services for their customer base and launch embedded financial solutions, banks also need to define new value propositions for their customers.

When defining the customer pain points, most banks identify invoicing and financial administration as one of the most important pain points for SME customers. Therefore, invoicing and invoice management is a good starting point for such a value-added service.

API banking for the corporate segment

Not only the SME sector requires digital solutions: in the corporate segment coupled with the in-house digitalization, enterprises are welcoming API-based services from banks, which radically increases the efficiency of their financial administration processes and ensures an automatic data exchange for transaction reconciliation, which is a time consuming, and yet unautomated area of transaction banking. The availability of invoice data gives a boost to supply chain financing and dynamic discounting solutions as corporate customers, their suppliers and the bank can work with invoice data as a shared asset on the same platform.

Request-to-pay (RTP) and QR code-based bill payments

There are tremendous opportunities in the integration of digital invoice management and request-to-pay or QR code-based payments. These value-added services to real time payments integrated with invoicing create a huge value added both on the biller and the SME/consumer side. If one can generate a payment request or QR code based on invoice data automatically, then invoice-payment reconciliation can be automated with 100% data accuracy and without the need of any reconciliation algorithms, as the invoice and payment data are directly linked. The efficiency increase potential combining invoice and payment data can reach up to 95% compared to paper-based processes for enterprises. This is clearly an area where banks can deliver substantial value for their customers. Request-to-pay and QR code payments will most likely start in the B2C segment, where payment requests can be approved in the mobile banking applications or in the online bank. Only the 2nd wave will be the B2B usage. For consumers bill management is more about paying and monitoring bills. However, the need to receive and manage all bills via a secure channel is becoming more and more important. If the bank makes it possible to present bills in internet banking, those bills will certainly be paid through the bank, and the transaction revenue will remain entirely at the bank. Furthermore, the bank acquires the data needed for PFM solutions through this channel.

As you can see invoicing is much more than a financial administration process. The digitalization of invoice management opens new business opportunities for banks to provide better banking experience for their customers.